In this post

A business will either make a profit or a loss when it operates. When the company does not reach the break-even point it requires, the costs to the business will be more than what is brought in. This means that the business will have made a loss. Once the business sells more stock than the break-even point, it will make a profit.

Gross and net profits

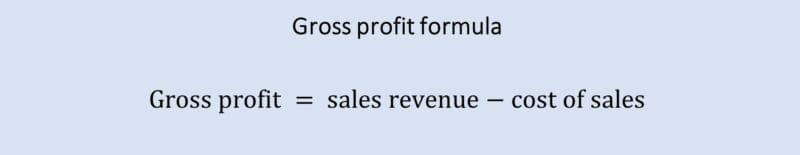

When working out the profit for a business, you can either calculate the gross or the net profit. The gross profit is the amount of money made from sales minus how much it costs to obtain these sales. The cost of sales will include manufacturing costs, advertising and distribution costs, as well as any other costs that are incurred in order to create and sell goods or services that a business produces.

The net profit of a business is quite different to the gross profit. It is the amount of money made from a business after all of the outgoings are taken into consideration. This means that the net profit is the gross profit minus all of the other expenses and interest that is incurred. These additional costs will include the wages of staff, utilities that are paid, and any taxes that are paid on the gross profit.

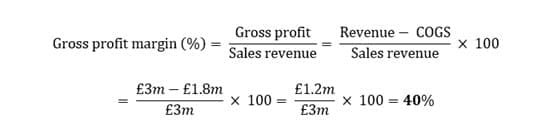

Gross profit margin

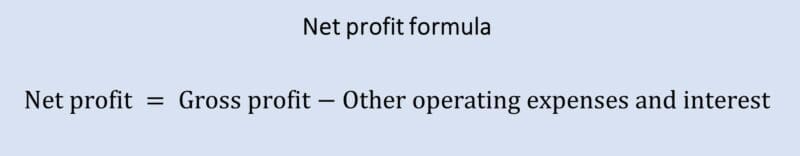

The gross profit margin is something that is used to calculate a company’s financial health. This formula for the gross profit margin finds out the proportion of money that is left over from revenues after subtracting the cost of goods sold (COGS). The cost of goods sold is the amount that is spent on manufacturing products and the cost of materials used. Therefore, this will include the labour costs for a business as well as staffing and other costs that are incurred when producing items. This number does not consider the cost of sales (for example advertising costs, distribution, delivery and the wages of sales staff), as the COGS is purely the amount of money that it cost to make the goods which are offered to a customer.

We can then use a formula to calculate the gross profit margin, which is shown below:

The gross profit margin is used to work out how much money a company actually makes on the goods that it sells. Fox example, if a company that produces soaps has an annual revenue of £3m and COGS-related expenses of £1.8m, we can work out the gross profit margin as:

This gives a gross profit margin of 40%. This therefore tells us that the soap business earns 40p gross profit on every £1 of revenue. Using this formula, you can work out the average gross profit for every sale that a business makes. Here we can spot a trend – the higher the gross profit margin is, the more money the business makes compared to its outgoings. So, a company with a low profit margin will have to pay a lot of money into developing and manufacturing products compared with a relatively low sale price. A product with a high gross profit margin will not spend much on making products, but can then sell these for a high price in comparison.

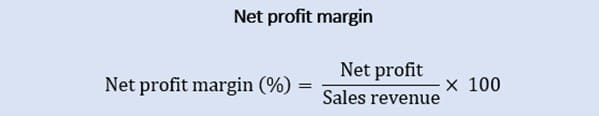

Net profit margin

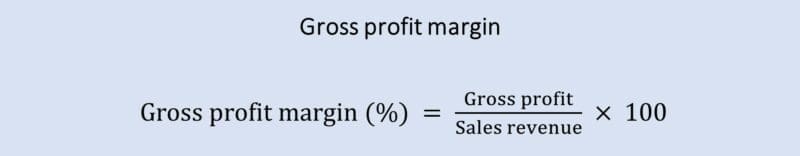

The net profit margin is similar to the gross profit margin, but instead tells us the revenue of the company after everything is paid out, including operating expenses and interest. The formula used for this is very similar to the gross profit margin formula we have just looked at

The net profit margin for a company will show us how much is made on a product after all outgoings are taken into consideration. Whereas the gross profit margin tells us the amount made compared to the costs of manufacturing, the net profit margin will tell us the earnings from a product when compared to the manufacturing costs as well as wages, marketing, and any other costs that a business has in order to operate.

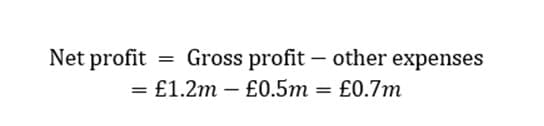

Take the example that we had previously for the gross profit margin. Let’s assume that the same company that made £3m in sales had to spend £500,000 on staffing costs and all other operations for the business. This would give us a net profit formula of:

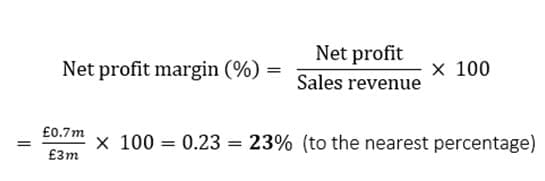

Using this net profit amount of £0.7m we can work out the net profit margin for the company as a whole using the formula we have just seen:

So, the business in our example which made £3m in sales has a gross profit margin of 40% and a net profit margin of 23%. Of course, without knowing what these numbers mean in real terms, they can be worthless. So, we must consider the meanings of these two percentages.

The gross profit margin tells us the amount of money that the business makes compared to what is spent on manufacturing and the ‘costs of goods sold’. This came out to be 40% which tells us that the business can expect to make a gross profit of 40p for every £1 that is spent on goods and manufacturing. Next, we worked out the net profit margin as 23%. This tells us that the business can expect to make 23p net profit on every £1 that is spent. This means that (after everything is paid off including manufacturing and other COGS, wages and salaries, running costs, legal fees and interests) the business will be left with 23p for every £1 that it spends on operating.

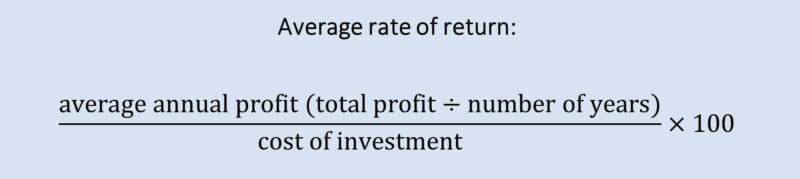

Rate of return

A business needs to make money in order to succeed. This is usually the main reason why someone starts a business; making a profit will help the company to be sustainable and continue to operate in the future. For this reason, the rate of return that is seen from products sold needs to be as high as possible

The rate of return will tell us how much money is made in a business from the funds that are invested. This is also known as the profitability of a business. All business owners want a company that makes a lot of money for the smallest amount of investment, so the average rate of return is better when it is high.

This type of measurement is a good thing to use as it relates the money made to the amount invested. This means that it does not take into account the amount of money that is actually made – only the proportion that is returned for an investment. This is important, because although one business may have higher profits, it might not always be the most profitable if the cost of the investment is very high.