In this post

Why is finance needed?

When starting a new business, finance is very important. It is very difficult to launch a new venture without some form of money being put in so that the business can purchase materials and other resources required to run it. Initial costs will include office space, desks, phones, computers, machinery, materials and advertising costs. Funds for a business can be separated into four different areas:

- Start-up capital – when first starting a company, there are a lot of ‘one-off’ purchases to be made. These will include things like desks, computers and machinery which will not be purchased multiple times. These costs can be very expensive depending on the nature of the business. For example, a business consultant may only need to buy a laptop when starting a new business whereas a new company that manufactures products will need expensive machinery, materials and wages. Extensive research is needed to ensure all of the start-up costs are understood and budgeted for

- Working capital – this is the money that is needed day-to-day in order to keep the business running. Working capital is brought in by a business through sales made or the selling of assets. This type of capital will be spent on purchasing new materials and goods as well as paying electricity, gas and supplier bills

- Expansion funds – when a business is already in operation and wants to take the next step in growth it may require money for an expansion. This will require the business to purchase new materials and goods or invest in new techniques that will generate an increase in orders. Doing this will usually result in new products that can be offered or an increase in the amount of goods and services that can be made by a business in order to sell

- Emergency funding – when an unexpected bill comes into a business it may take emergency funding to keep the business operating. This can be from fines that are issued or unexpected tax bills. In an emergency situation, a business must be able to raise money quickly so that the bill can be paid off and the business survives

Short-term sources of business finance

Often a business will need finance in the short term if it needs a boost in working capital. Many businesses will need this type of finance so that they can pay unexpected bills or to capitalise on opportunities that arise. A firm may also need finance in the short term because it is waiting for a customer to pay off a debt owed and needs some money to continue operating before this is paid.

Short-term finance is used for up to 12 months and can come through many different means such as:

- Bank overdrafts – this type of finance is very common in business and allows a company to spend more than it has in the bank. This is known as going overdrawn. This type of finance is easy to acquire and very flexible but can incur large costs if the money is not paid back into the bank account after a certain amount of time

- Bank loans – a bank loan is a more fixed agreement than an overdraft and will have specific terms and conditions. These terms can vary between banks and different types of loans but will typically outline the loan period, how much interest is to be paid and when instalments are due to be paid back. This type of finance will allow a business to know exactly what it must pay every single month

- Hire purchase – many companies will use hire purchase (HP) to buy tools, vehicles and other equipment. This helps a business to get the things it needs without actually having to buy them outright. Typically, a down payment is used which is then followed by a number of monthly payments. Hire purchases are often more expensive than bank loans and therefore may not give good value for money

- Trade credit – suppliers to businesses will often allow materials to be purchased with an agreement to pay at a later date. This is known as trade credit and the resources are given to the person who then pays for them later (usually between 30 and 90 days afterwards). This can have a huge number of benefits for a business. The main one being that it allows businesses to undertake jobs that require materials without any capital at the start. Builders, plasterers and other tradesmen use trade credit all the time in order to get materials for their work, carry out a job and then use the money they are paid to finally pay for the materials that are used. Trade credit prices will be more expensive when paying for goods but it is generally cheaper than using a bank loan

- Credit cards – this type of finance is very common because credit cards are convenient and flexible. Businesses will use credit cards to pay for goods or for expenses when travelling away on business. Interest rates are notoriously high though, and if accounts are not settled in the period set out (usually 56 days), then costs can spiral out of control

Long-term sources of business finance

When money is needed in a business for a long time (upwards of 12 months) then long-term finance options will be used. External sources of long-term finance can come in many ways such as:

- Share capital – for a limited company, share capital is very important as a method of raising money. Selling off shares in the business will raise a lot of money but will also lose the owners control of the company and potentially change the course of the business as a whole. Shareholders will also expect to be paid dividends when they hold shares in a business

- Owner’s capital – most small businesses are set up using money from an owner. This is money that belongs to the original owners who invest in the business first. This is obviously easy to acquire and will not require any interest payments to be made. The downside is that this amount of finance is limited and will likely not be enough to start a new venture. As well as this, money that is put into a business by an owner may put them at risk of losing their own personal savings if the business does not work out

- Loans – when money is borrowed it is known as loan capital. This type of money is usually acquired from banks or other financial institutions and will need to be paid back eventually. Loans are paid back with interest and this interest rate will often depend on the risk that is associated with the company

- Venture capital – when a business is very new but risky to invest in, venture capital can be raised. Often banks are unwilling to invest in a business that is risky so loans are not possible – leaving venture capitalists as the best remaining option. Venture capitalists (the people that invest in the business) will take a percentage stake in the company in exchange for finance which could be their own money or taken from other lenders. This means that although venture capital may be the only option in some cases, a loss of control is to be expected in this type of finance

- Retained profit – once a business is established and making money it will be able to retain some of this money. This means that rather than paying out all of the profits to the owners, money is kept in the business ready to invest. Of course, the downside to this is that a profit must be made first, so this method is unsuitable for new ventures. On the plus side, the owners do not have to give away control of the company and there is no interest to be paid on the money used

- Crowdfunding – this type of finance comes from a large number of people who all put in smaller amounts of capital to a venture. This can be used to raise finances in a number of industries and often gives large amounts of finance as lots of people invest in the business. The actual investment will vary depending on different circumstances but is often reward-based where investors receive money back once the business makes a profit

Interest

When a business takes out a loan in order to finance an expansion, interest will be paid on the money borrowed. This interest is the reason why someone will choose to lend money to a business in the first place – they are paid back more money than they put in, leading to a profit for the lender.

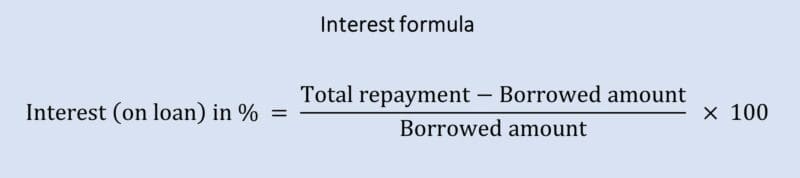

Interest rates on loans are given in percentages and show the amount that will be paid back on top of the borrowed amount. The formula shown below is what should be used when calculating the interest rate from loan repayments.

Using the formula above, we can find out the interest on a loan when we know the amount that is borrowed and paid back. For example, if a business borrows £12,000 and pays back £13,000 over the course of a year, we can put these figures into the formula shown. Here £12,000 is the borrowed amount and £13,000 is the total repayment.

So, in our example here, the interest on a loan of £12,000 if £13,000 is paid back is 8.3%.

This interest rate formula can be used in a different manner if we move around some of the things in the equation. With most lenders who offer loans, the percentage interest rate will be known straight away when taking the loan out but it is the total amount to be paid back that we do need to work out.

Using this formula, a business will be able to work out the amount it must repay when taking out a loan, as long as it knows the interest rate. For example, if a business takes out a loan of £35,000 with an interest rate of 4%, we can place these values into the formula above and easily work out the amount that is to be paid back.

So, in the example above, the business has taken out a loan of £35,000 and will need to pay back £36,400. This represents a 4% interest rate.

Choosing a source of finance

With the large number of options for a business when looking for finance, it can be difficult to find the right method of raising money. When choosing a finance option you must be able to weigh up the different alternatives and choose the most suitable. Things to consider will include:

- Cost – when securing finance, it is obviously best to go for an option that is cost efficient. Some finance options can be very expensive and will lead to a loss of money in the long term. Most sources of finance such as mortgages and bank loans offer very competitive and affordable rates but the amount that is paid back will depend on how secure the business is

- Control – some sources of finance require the owners of a business to give up a certain amount of control over their company. This will include when selling shares of the company or inviting venture capitalists into the business. Losing control can result in the company going in a direction that you did not plan on or the business taking off and the owners not getting the same percentage of dividends that they are used to

- Risk – when securing finance to expand a business, loans are often taken out. This can be quite risky due to the interest that is payable on these loans. If a company already has a large amount of loans that have been taken it will likely try to raise finance through other methods instead

- Status and size – businesses will be limited in their choice of finance by their own size and status. A typical sole trader will have to rely on hire purchases or putting in their own money to a project as they are less likely to attract venture capitalists or secure a large loan from a bank. A public or private limited company is much more likely to secure finance from a bank or through a venture capitalist though, as they are seen as a more secure investment